Embedded Payments

The rapid advancement of technology has brought with it significant changes in the way people interact with financial services. Embedded payments, also known as embedded finance, have emerged as a key trend driving the future of digital transactions. This paradigm shift in payments infrastructure is transforming how businesses operate, making it crucial for companies to evaluate their readiness for this new era of financial services.

What is Embedded Payments?

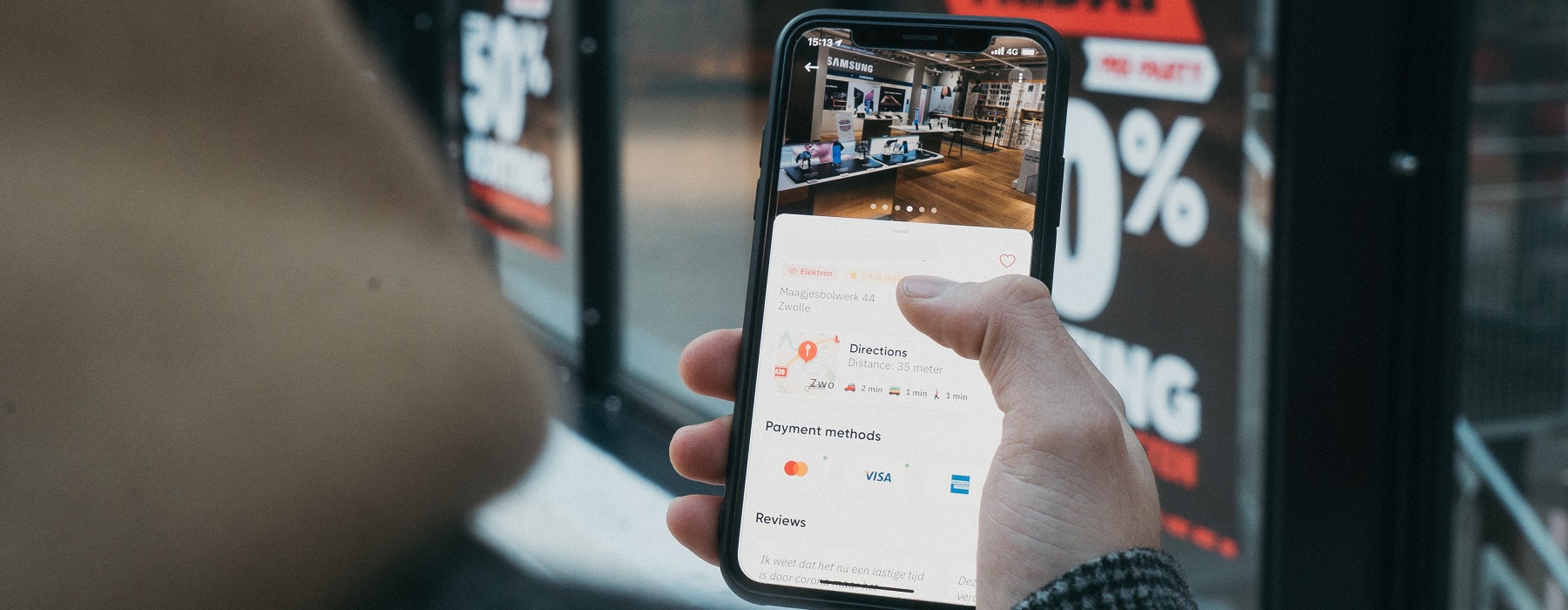

Embedded payments refer to the seamless integration of financial services into non-financial platforms, applications, or software. By incorporating payments directly into their digital platforms, businesses can offer customers a more convenient, frictionless, and secure transaction experience. This innovative approach allows companies to generate new revenue streams, reduce transaction costs, and improve overall customer satisfaction.

The rise of embedded payments is largely due to the increasing demand for digital services, fueled by changing consumer preferences, as well as the widespread adoption of smartphones and mobile applications. The pandemic further accelerated this shift, as social distancing measures and remote work policies resulted in a surge of online shopping and digital transactions. As a result, embedded payments have become an essential component of today’s digital economy.

Benefits and Challenges of Embedded Payments

One of the main benefits of embedded payments is the ability to provide a seamless customer experience, which is vital for building brand loyalty and trust. By eliminating the need for customers to navigate multiple platforms or applications to complete a transaction, businesses can significantly reduce friction and simplify the purchasing process. In addition, embedded payments allow businesses to gather valuable data on customer spending habits, preferences, and behaviors, which can be used to inform future marketing strategies and product development.

Another advantage of embedded payments is the potential to create new revenue streams for businesses. By integrating financial services directly into their platforms, companies can offer a wider range of services to customers and generate additional income from transaction fees and value-added services. This diversification of revenue sources can help businesses become more resilient and better positioned to weather economic downturns or other challenges.

Embedded payments also offer opportunities for cost savings, as businesses can reduce the expenses associated with traditional payment processing methods. By leveraging technology to automate and streamline transactions, companies can minimize operational costs and increase overall efficiency. Furthermore, embedded payments provide greater security, as they often involve advanced encryption and fraud detection measures that can protect both businesses and customers from cyber threats.

While embedded payments present numerous benefits, they also bring about challenges and potential risks. Companies looking to integrate embedded payments into their operations must navigate complex regulatory environments, as financial services are subject to strict compliance requirements in many jurisdictions. Additionally, businesses must ensure the security of their systems and customer data, as the integration of financial services can increase vulnerability to cyberattacks and data breaches.

In response to these challenges, many companies are partnering with fintech providers or banking-as-a-service (BaaS) platforms to implement embedded payments. These partnerships allow businesses to access the necessary infrastructure, technology, and expertise to seamlessly integrate financial services into their existing platforms, while also ensuring compliance with relevant regulations.

The Future of Embedded Payments

As the popularity of embedded payments continues to grow, banks and financial institutions are also beginning to recognize the potential of this innovative approach. Rather than viewing embedded payments as a threat to their traditional business models, many banks are now embracing the trend and seeking to collaborate with fintech providers or develop their own embedded finance solutions. This shift toward a more consumer-centric approach allows banks to tap into new customer segments, enhance their service offerings, and stay competitive in an increasingly digital financial landscape.

To ensure success in the age of embedded payments, businesses must be prepared to adapt their strategies and invest in the necessary technology and infrastructure. By focusing on delivering seamless, secure, and customer-centric experiences, companies can capitalize on the numerous opportunities presented by embedded payments, while also navigating the associated risks and challenges.As the world continues to embrace digital solutions, businesses need to stay ahead of the curve by incorporating embedded payments into their operations. This innovative approach to financial services can help companies maintain a competitive edge, while also meeting the evolving needs and expectations of today’s digitally-savvy consumers.

Ecommerce, Sharing Economy, Internet of Things, and Subscriptions

One area where embedded payments are making a significant impact is in the realm of e-commerce. By integrating payment solutions directly into online shopping platforms, merchants can streamline the checkout process and reduce cart abandonment rates. This not only enhances the customer experience but also increases conversion rates and overall sales.

Embedded payments are also gaining traction in the sharing economy and on-demand services sector, where they enable users to quickly and easily access services such as ride-hailing, food delivery, or vacation rentals. By incorporating financial services directly into these platforms, businesses can create a more user-friendly experience, ensuring that customers can complete transactions with minimal friction.

Another industry being transformed by embedded payments is the Internet of Things (IoT). As more devices become connected and capable of processing transactions, there is a growing demand for seamless payment solutions. Embedded payments can help facilitate transactions between IoT devices, enabling new business models and revenue streams for companies in this space.

Moreover, embedded payments are playing a crucial role in the growth of subscription-based business models. By integrating recurring payment solutions into their platforms, companies can simplify the billing process for customers and ensure a steady revenue stream. This approach can be particularly beneficial for businesses offering digital services, such as streaming platforms, online publications, and software-as-a-service (SaaS) providers.

Capitalizing on Embedded Payments

To capitalize on the potential of embedded payments, businesses must also consider the importance of collaboration and partnerships. By working with fintech providers, banks, or other financial institutions, companies can access the necessary expertise and resources to successfully implement embedded payment solutions. These partnerships can help businesses overcome regulatory hurdles, navigate security concerns, and ensure that their embedded payment offerings align with customer expectations.

In addition to partnering with established players in the financial sector, businesses should also stay informed about emerging trends and developments in the embedded payments space. By staying up-to-date on the latest technologies, regulatory changes, and industry best practices, companies can ensure that their embedded payment solutions remain relevant and competitive in a rapidly-evolving landscape.

Finally, it is essential for businesses to prioritize data privacy and security when implementing embedded payment solutions. With increasing concerns about cyber threats and data breaches, customers are more vigilant than ever about the safety of their personal and financial information. By investing in robust security measures and maintaining transparency about their data protection policies, businesses can build trust with their customers and mitigate potential risks associated with embedded payments.

In summary, embedded payments represent a significant shift in the way businesses and consumers engage with financial services, offering unparalleled convenience, security, and efficiency. By embracing this trend and investing in the necessary technology and partnerships, businesses can unlock new opportunities for growth, diversification, and customer satisfaction. As the world becomes increasingly digital, embedded payments will undoubtedly play a crucial role in shaping the future of commerce and financial services, making it imperative for businesses to adapt and evolve to stay ahead of the curve.